are car loan interest payments tax deductible

The interest on a car title loan is not generally tax deductible. You would also have to claim actual vehicle expenses rather than the standard mileage rate for your vehicle expenses.

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

So no you cannot deduct the entire monthly car payment from.

. If you have your own business or are self-employed and the car is used for your. Unfortunately car loan interest isnt deductible for all taxpayers. Interest from mortgage payments is tax deductible if the loan is secured on a first or second home.

If you are not then you will not be able to claim any tax relief on car loan payments. However you can still get a bit of a tax break if you have a mortgage on a first or second home or if you are repaying student loans. More specifically if you borrowed money to buy a car you may well be asking are car loan payments tax deductible The answer to this is possibly but it depends on a number of factors.

Interest paid on a loan to purchase a car for personal use. If certain conditions are met you can deduct some or all of the interest payments you make on your car loan from your federal taxes. Interest But before you file your tax return make sure you dont fall into any of the following three personal loan exceptions.

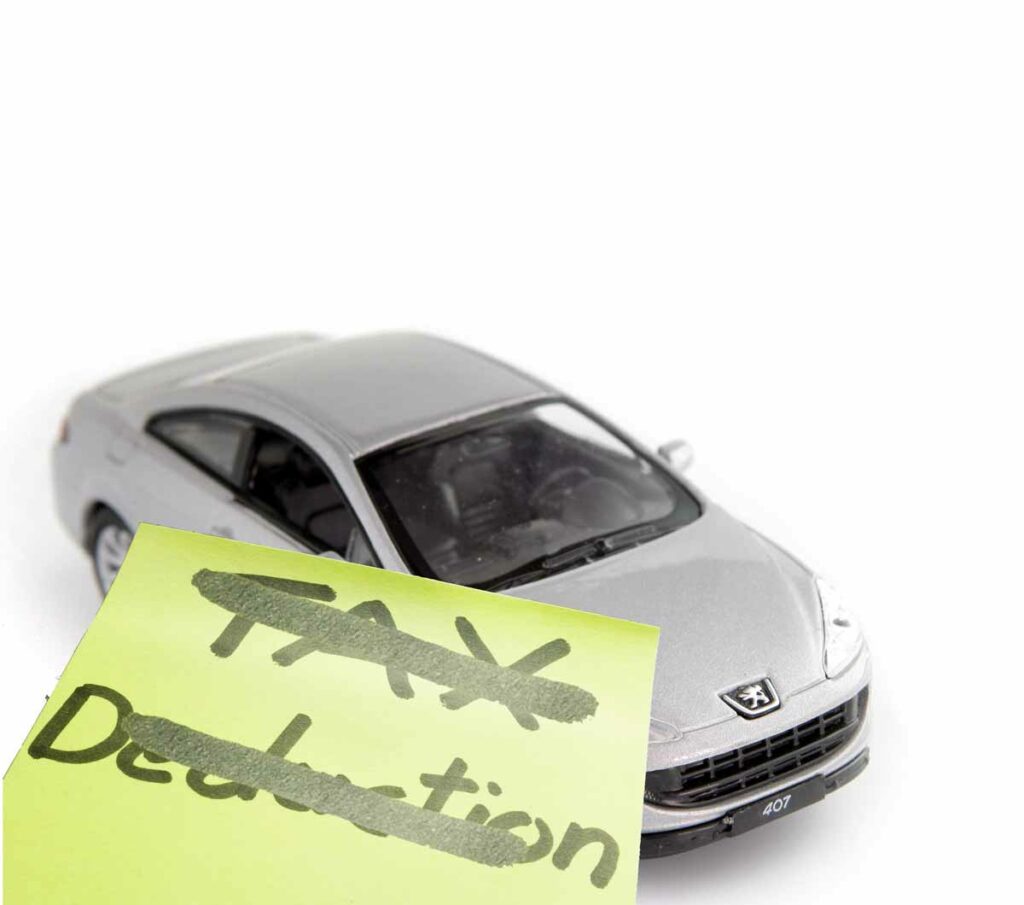

Of course there is a caveat and its why most people cant use their loan payments as a tax deduction. Interest on car loans may be deductible if you use the car to help you earn income. Typically deducting car loan interest is not allowed.

The faster you pay off your car title loan the less you will pay in interest. The only exception to this rule is if your car is used for business purposes in which case you will qualify for a car loan tax deduction. You can only use a loan as tax-deductible if the vehicle is for a business.

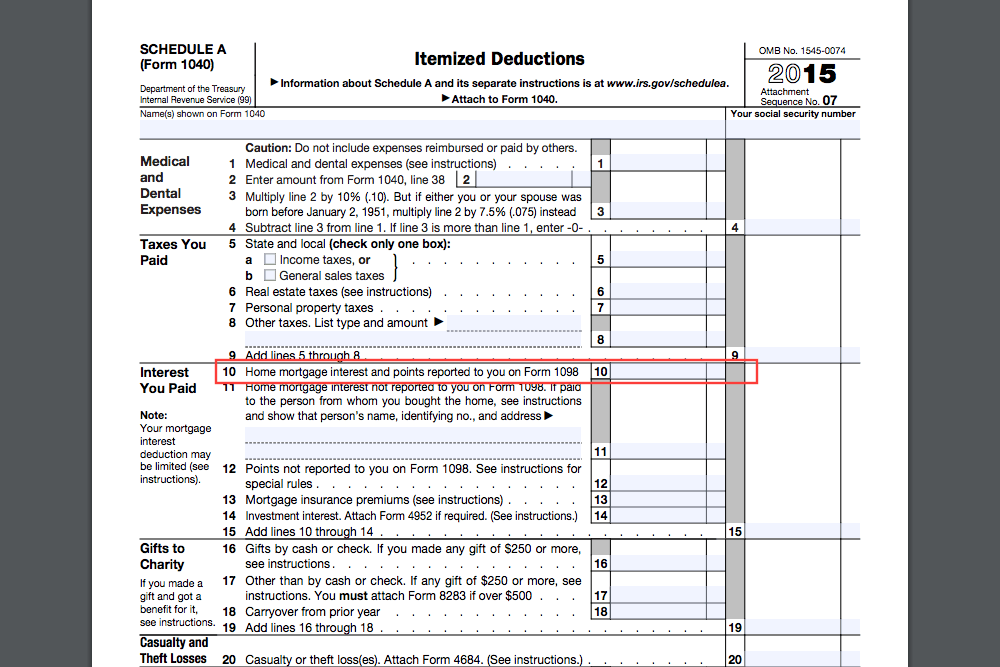

Interest Payment Deductions The cost of a vehicle is not a deductible expense but the IRS does allow you to write off any interest payments made on a loan for the purchase. You can deduct the interest paid on an auto loan as a business expense using one of two methods. Tax-deductible interest is interest paid on loans that the IRS allows you to subtract from your taxable income.

The answer to is car loan interest tax deductible is normally no. Types of interest not deductible include personal interest such as. While you cannot deduct the 1500 payments you make on the principal loan amount you can deduct the 500 a month you pay in interest.

However LoanMart has competitive interest rates and long repayment terms so you can pay off your loan FAST which can be a much better benefit. You might pay at least one type of interest thats tax-deductible. Should you use your car for work and youre an employee you cant write off any of.

Car loan payments and lease payments are not fully tax-deductible. As a rule of thumb interest paid on a car loan home equity loans credit card debt or loans used for personal finance is not deductible. Interest paid on personal loans car loans and credit cards is generally not tax deductible.

Read on for details on how to deduct car loan interest on your tax return. However if the vehicle was used for a business purpose you may be able to deduct some or all of the cost against your self-employment income. But writing off car loan interest as a business expense isnt as easy as just deciding you want to start itemizing your tax return when you file.

Unfortunately auto loan interest no longer qualifies to be deducted from your taxes. The first question you need to answer is whether or not you are self-employed. The same is valid for interest payments on your business credit card business line of credit business car loan or any loan youre taking out exclusively for a business expense.

You must report your tax-deductible interest to the IRS and this invariably means filing additional. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. Credit card and installment interest incurred for personal expenses.

Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer but it is not deductible for personal use. But you can deduct these costs from your income tax if its a business car. You actually should be able to.

The general rule of thumb for deducting vehicle expenses is you can write off the portion of your expenses used for business. It can also be a vehicle you use for both personal and business purposes but you need to account for the usage. Interest paid on personal loans car loans and credit cards is generally not tax deductibleHowever you may be able to claim interest youve paid when you file your taxes if you take out a loan or accrue credit card charges to finance business expenses.

But you cant just subtract this interest from your earnings and pay tax on the remaining amount. If you do use your vehicle for business a. Interest on vehicle loans is not deductible in and of itself.

If you use your car for business purposes you may be able to deduct actual vehicle expenses. Answered on Dec 03 2021. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes.

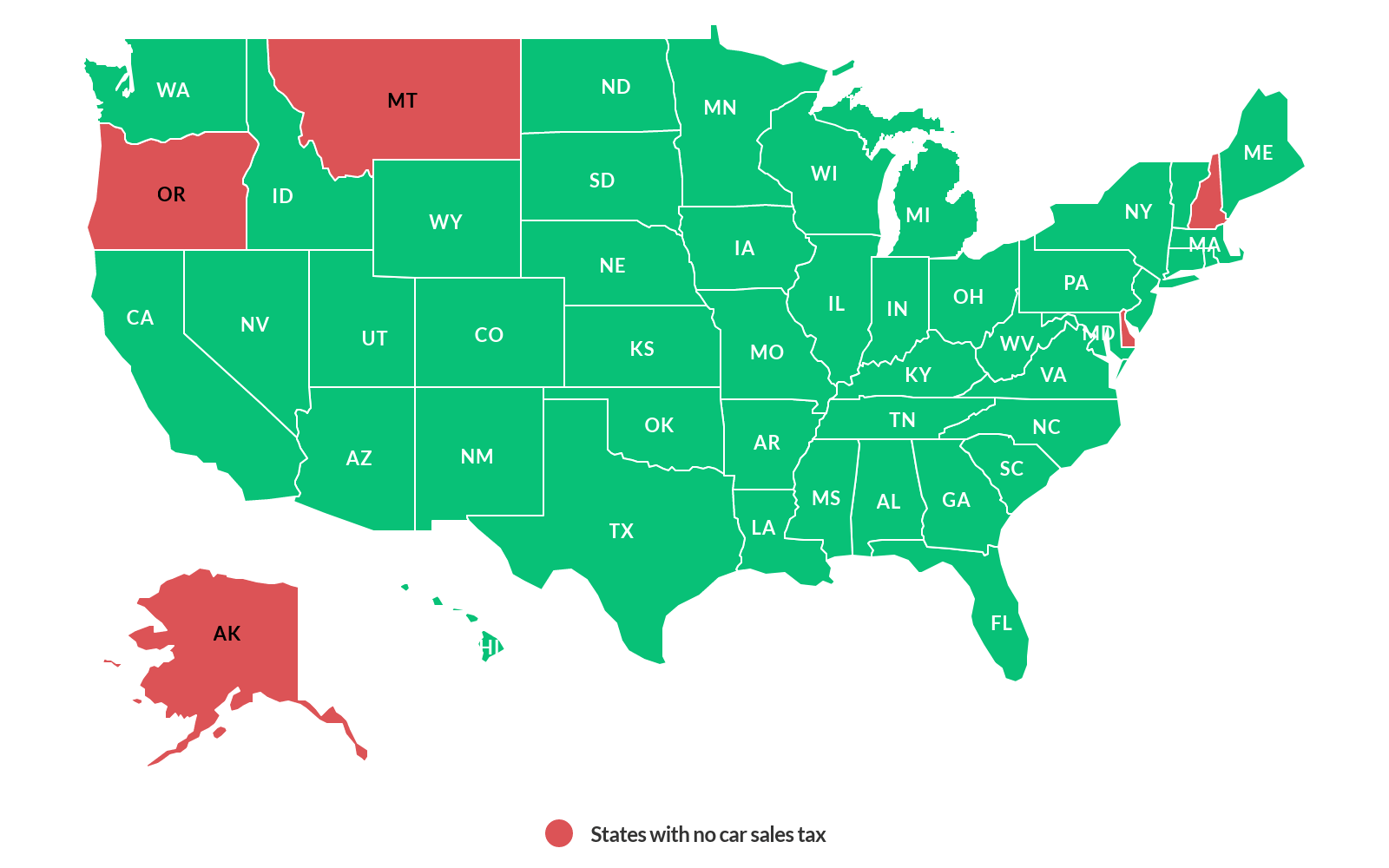

In most cases your car loan interest is not tax deductible. Interest on loans is deductible under CRA-approved allowable motor vehicle expenses. The expense method or the standard mileage deduction when you file your taxes.

But there is one exception to this rule. In addition loan interest is one of the few expenses you can deduct in addition to the standard mileage deduction the others are registration fees tolls and parking charges.

Car Loan Tax Benefits And How To Claim It Icici Bank

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

How To Write Off Vehicle Payments As A Business Expense

Can I Write Off My Car Payment

New Business Vehicle Tax Deduction Buy Vs Lease Windes

10 Things You Should Never Deduct From Your Taxes All Time Lists In 2021 Best Car Insurance Car Insurance Online Car Buying

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

Can I Write Off My Car Payment

Can I Write Off My Car Payment Purchase For Delivery Or Rideshare

Is Buying A Car Tax Deductible Lendingtree

Can I Write Off My Car Payment For Tax Purposes

Is Buying A Car Tax Deductible In 2022

Mortgage Affordability Tax Benefits Payoff Strategies Mortgage Mortgage Interest Rates Debt To Income Ratio

Is Buying A Car Tax Deductible In 2022

6 Surprising Tax Deductions For Uber And Lyft Drivers

Irs Tax Forms Infographic Tax Relief Center Irs Taxes Irs Tax Forms Tax Forms

Pin By Si Skimo On New Offer Cash Out Refinance Loan Interest Rates Free Quotes

Car Loan Tax Benefits On Car Loan How To Claim Youtube

Are Lender Credits Tax Deductible Fast Auto And Payday Loans Corporate Office Paydayloans Payday Loans Loan Lenders Easy Payday Loans